A Biased View of Real Estate Reno Nv

A Biased View of Real Estate Reno Nv

Blog Article

The Single Strategy To Use For Real Estate Reno Nv

Table of ContentsThe Best Strategy To Use For Real Estate Reno NvHow Real Estate Reno Nv can Save You Time, Stress, and Money.The 7-Minute Rule for Real Estate Reno NvNot known Details About Real Estate Reno Nv 6 Easy Facts About Real Estate Reno Nv ExplainedAll About Real Estate Reno Nv

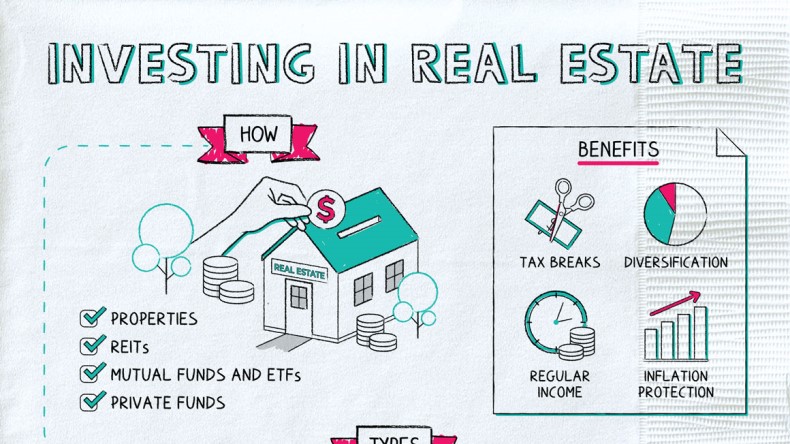

The advantages of buying realty are many (Real Estate Reno NV). With well-chosen properties, financiers can take pleasure in foreseeable money circulation, outstanding returns, tax benefits, and diversificationand it's possible to take advantage of property to construct wealth. Considering buying realty? Below's what you require to find out about realty benefits and why actual estate is considered an excellent financial investment.

The benefits of investing in realty consist of easy revenue, stable money flow, tax benefits, diversification, and take advantage of. Realty investment company (REITs) provide a method to purchase property without having to own, run, or financing residential or commercial properties. Cash money circulation is the earnings from a genuine estate investment after mortgage payments and operating budget have been made.

Realty values tend to raise over time, and with a great financial investment, you can transform a profit when it's time to sell. Rents additionally often tend to increase over time, which can lead to greater cash money flow. This chart from the Reserve bank of St. Louis reveals typical home prices in the U.S

Not known Details About Real Estate Reno Nv

The areas shaded in grey suggest united state economic crises. Average Sales Cost of Houses Offered for the USA. As you pay for a residential or commercial property home loan, you develop equityan property that's part of your net worth (Real Estate Reno NV). And as you develop equity, you have the take advantage of to buy even more residential properties and boost cash flow and wealth a lot more.

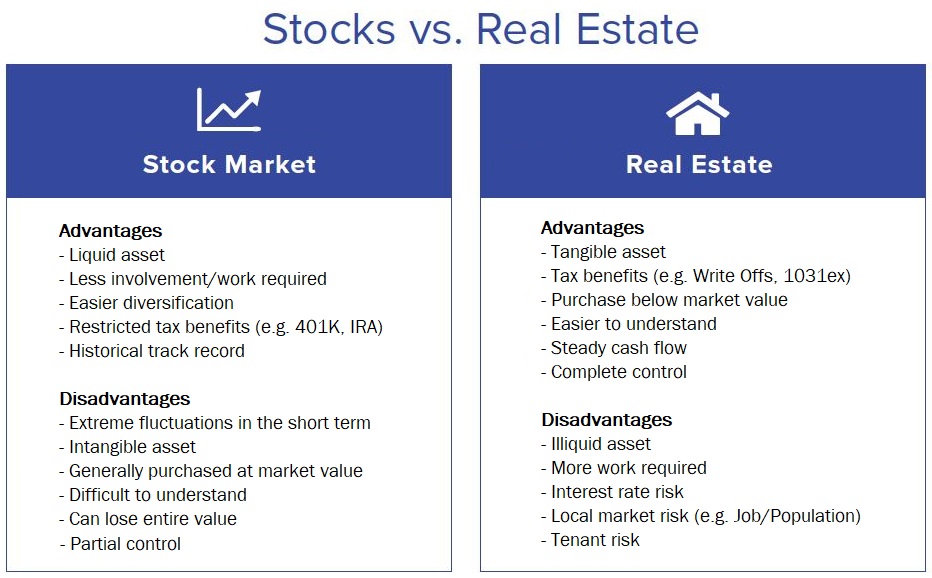

Realty has a lowand in many cases negativecorrelation with various other major asset courses. This implies the enhancement of real estate to a portfolio of diversified properties can decrease profile volatility and supply a higher return each of threat. Leverage is making use of various financial instruments or borrowed funding (e.

Fascination About Real Estate Reno Nv

As economic climates expand, the demand genuine estate drives rents higher. This, in turn, converts into higher resources values. Genuine estate has a tendency to keep the acquiring power of funding by passing some of the inflationary pressure on to renters and by incorporating some of the inflationary stress in the form of resources recognition.

There are a number of methods that possessing real estate can protect against rising cost of living. Second, rents on investment residential properties can increase to keep up with inflation.

In spite of all the advantages of spending in genuine estate, there are downsides. One of the major ones is the absence of liquidity (or the loved one trouble in transforming an asset into cash and cash into a possession).

The Facts About Real Estate Reno Nv Uncovered

But among the most basic and most typical approaches is just acquiring a home to lease to others. Why spend in actual estate? Nevertheless, it calls for a lot more work than simply clicking a few buttons to invest in a common fund or supply. The reality is, there are many property advantages that make it such a preferred option for experienced investors.

However the rest mosts likely to paying down the finance and structure equity. Equity is the value you have in a property. It's the distinction between what you owe and what the home or land deserves. With time, routine repayments will eventually leave you possessing a property cost-free and clear.

The Definitive Guide for Real Estate Reno Nv

Any individual that's visit this site right here shopped or filled their storage tank lately understands exactly how rising cost of living can damage the power of hard-earned money. One of the most underrated realty benefits is that, unlike numerous conventional financial investments, property worth tends to increase, also during times of noteworthy rising cost of living. Like other essential properties, property usually keeps value and can as a result operate try this website as an outstanding location to spend while greater rates eat away the gains of different other financial investments you may have.

Gratitude refers to cash made when the overall value of an asset rises in between the time you buy it and the time you market it. For genuine estate, this can indicate significant gains because of the typically high rates of the assets. Nevertheless, it's critical to bear in mind gratitude is a single thing and only gives cash when you sell, not in the process.

As mentioned previously, capital is the cash that begins a monthly or yearly basis as an outcome of possessing the building. Usually, this is what's left over after paying all the essential expenses like home mortgage repayments, repair work, tax obligations, and insurance policy. Some residential properties might have a significant capital, while web others may have little or none.

Real Estate Reno Nv for Dummies

New investors may not absolutely understand the power of utilize, but those that do open the capacity for substantial gains on their investments. Usually talking, utilize in investing comes when you can have or manage a bigger amount of possessions than you might otherwise pay for, via the use of credit scores.

Report this page